Course: AFAS200

Type: Individual Assignment

Principles of Financial Literacy Assignment

Important Notes:

- The assignment/report must be typed (font 11, Arial or Times New Roman)

- There is no specific template or format for the report; however, you need to ensure your report is technically accurate, reader friendly and professionally presented in line with the industry best practice.

- Tips: your report should contain a cover letter, table of contents, headings, etc. Also, where appropriate, tables, graphs, flowcharts, etc to help illustrate your points clearly. Marks will be awarded for the presentation of your work

- Attempt ALL questions

- Show workings and calculations where applicable

- Assumptions can be made, however, they need to be reasonable and logical and cannot conflict with the facts in the question/s and must be clearly stated

- Always explain and justify your answer/s /recommendation/s

- Clearly state your source reference/s

- Total maximum word limit is 4,000 words

Plagiarism: Where Systemic Plagiarism is found to be committed by any student/s, it will render the student/s involved a zero mark and possible further disciplinary actions by the University

Principles of Financial Literacy Case study

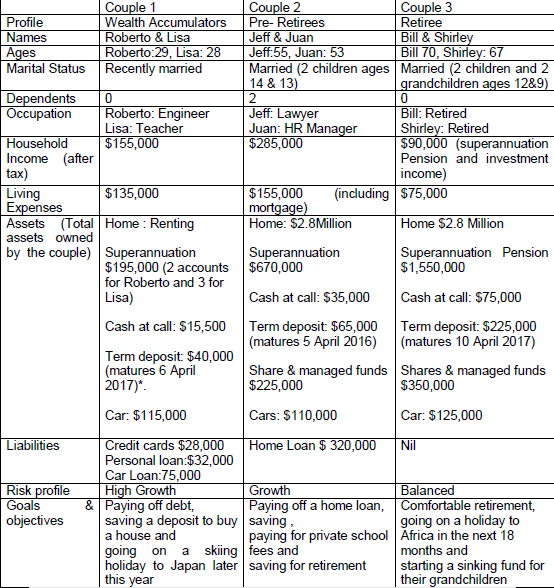

Couples information

Principles of Financial Literacy Assignment Questions

IN YOUR OWN WORDS You need to prepare a report to answer the questions below related to the 3 couples above. Your report needs to explain and discuss issues asked in the questions below and related to the 3 couples, specific circumstances.

- Advise the 3 couples on the need for budgeting and financial planning to help meet their goals and objectives. In your answer also address the benefits of appropriate budgeting and planning and the risks of not budgeting and or planning. Be specific, relate to each of the couple personal circumstances

- Discuss and explain the different investment strategies below highlighting their key advantages and disadvantages. Comment specifically on the suitability of each of these investments strategies to each of the clients above. Clearly explain and justify your answer.

- investment via Mutual trust/Managed funds

- Investment in Government and Corporate bonds

- Use of Gearing (borrowing to invest)

- Investment in Gold Bullion

- Explain the concept of risk management as an important financial planning consideration and how insurance can be used in managing key personal risks. In you answer List 1personal and 1 general insurance recommendations to each of the 3 couples and explain why they should be (you need to list and explain 2 recommendations for each of the couples, 6 in total)

- Explain why it’s important to consider superannuation as part of saving for retirement and retirement palming. List and explain 2 possible superannuation/pension recommendations or strategy and explain why they would be considered by each of the 3 couples (you need to list and explain 2 recommendations for each of the couples, 6 in total)

- Explain why it’s important to consider having a valid will and an appropriate power of attorney as part of the couples’ estate planning highlighting the benefits and risks as applicable. In your answer relate specifically to each of the 3 couples individual circumstances.

- Report Presentation. Your report needs to be professionally presented and reader friendly

NOTE! AEssay Team of professional writers have already completed this assignment. We are ready to help You with it. Please use the coupon code AE-FB-2018-15 to get a discount if You order till the end of 2018 or contact our support to get a new one.